The tax burden share by level of government OECD-30, as a proportion of... | Download Scientific Diagram

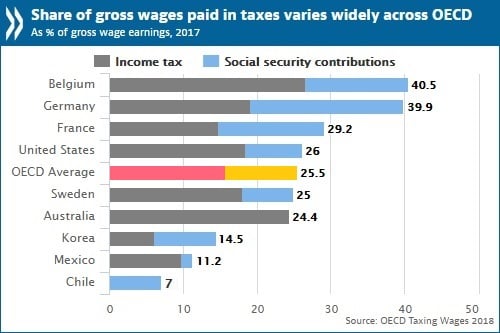

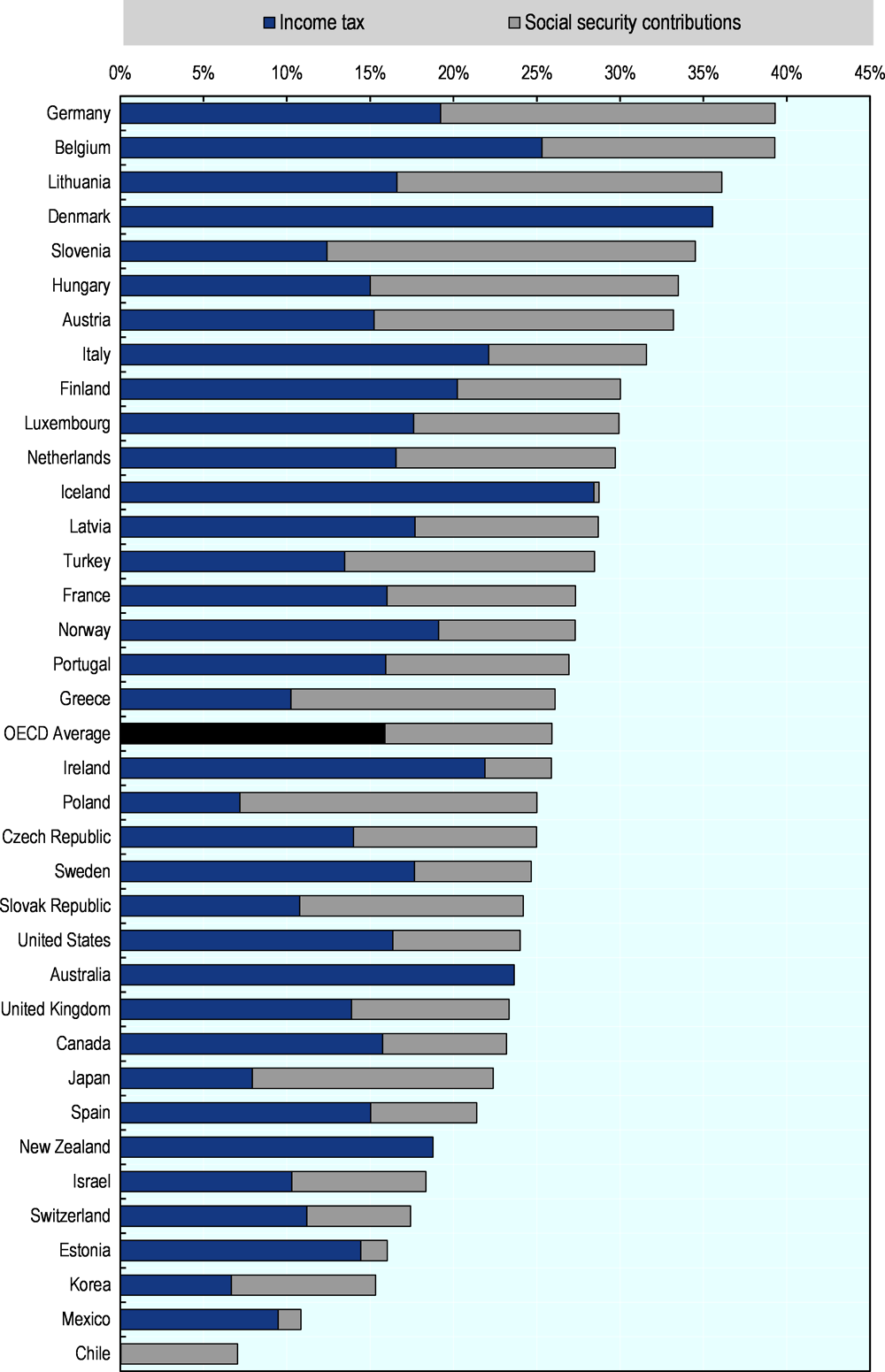

OECD ➡️ Better Policies for Better Lives on X: "#Tax wedge: What you earn vs what your employer really pays. Compare w/other #OECD countries, then read #TaxingWages https://t.co/zwd0kb1lQp https://t.co/FwjWY0eT2T" / X